Page 123 - TACC 2023 Program

P. 123

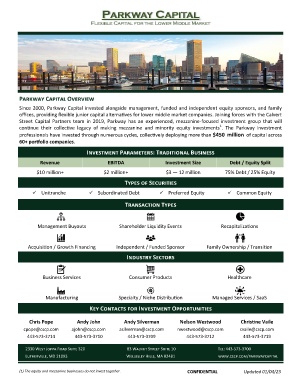

PARKWAY CAPITAL

FLEXIBLE CAPITAL FOR THE LOWER MIDDLE MARKET

Parkway Capital Overview

Since 2000, Parkway Capital invested alongside management, funded and independent equity sponsors, and family

offices, providing flexible junior capital alternatives for lower middle market companies. Joining forces with the Calvert

Street Capital Partners team in 2019, Parkway has an experienced, mezzanine-focused investment group that will

1

continue their collective legacy of making mezzanine and minority equity investments . The Parkway investment

professionals have invested through numerous cycles, collectively deploying more than $450 million of capital across

60+ portfolio companies.

Investment Parameters: Traditional Business

Revenue EBITDA Investment Size Debt / Equity Split

$10 million+ $2 million+ $3 — 12 million 75% Debt / 25% Equity

Types of Securities

✓ Unitranche ✓ Subordinated Debt ✓ Preferred Equity ✓ Common Equity

Transaction Types

Management Buyouts Shareholder Liquidity Events Recapitalizations

Acquisition / Growth Financing Independent / Funded Sponsor Family Ownership / Transition

Industry Sectors

Business Services Consumer Products Healthcare

Manufacturing Specialty / Niche Distribution Managed Services / SaaS

Key Contacts for Investment Opportunities

Chris Pope Andy John Andy Silverman Nelson Westwood Christine Vaile

cpope@cscp.com ajohn@cscp.com asilverman@cscp.com nwestwood@cscp.com cvaile@cscp.com

443-573-3714 443-573-3710 443-573-3709 443-573-3712 443-573-3719

2330 West Joppa Road Suite 320 83 Walnut Street Suite 10 Tel: 443-573-3700

Lutherville, MD 21093 Wellesley Hills, MA 02481 www.cscp.com/parkwaycapital

(1) The equity and mezzanine businesses do not invest together. CONFIDENTIAL Updated 01/04/23