Page 160 - TACC 2023 Program

P. 160

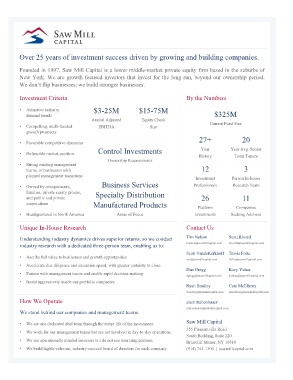

Over 25 years of investment success driven by growing and building companies.

Founded in 1997, Saw Mill Capital is a lower middle-market private equity firm based in the suburbs of

New York. We are growth focused investors that invest for the long run, beyond our ownership period.

We don’t flip businesses; we build stronger businesses.

Investment Criteria By the Numbers

• Attractive industry $3-25M $15-75M

demand trends $325M

Annual Adjusted Equity Check

• Compelling, multi-faceted EBITDA Size Current Fund Size

growth prospects

27+ 20

• Favorable competitive dynamics

Control Investments Year Year Avg. Senior

• Defensible market position

History Team Tenure

Ownership Requirements

• Strong existing management

teams, or businesses with 12 3

planned management transitions

Investment Person In-house

• Owned by entrepreneurs, Business Services Professionals Research Team

families, private equity groups, Specialty Distribution

and public and private 26 11

corporations Manufactured Products Platform Companies

• Headquartered in North America Areas of Focus Investments Seeking Add-ons

Unique In-House Research Contact Us

Understanding industry dynamics drives superior returns, so we conduct Tim Nelson Scott Rivard

industry research with a dedicated three-person team, enabling us to: [email protected] [email protected]

Scott VandeKerkhoff Travis Foltz

• Ascribe full value to businesses and growth opportunities

[email protected] [email protected]

• Accelerate due diligence and execution speed, with greater certainty to close

Dan Gregg Kacy Yuhas

• Partner with management teams and enable rapid decision-making

[email protected] [email protected]

• Invest aggressively inside our portfolio companies

Ryan Bradley Cam McElheny

[email protected] [email protected]

How We Operate Zach Rubenbauer

[email protected]

We stand behind our companies and management teams.

• We are one dedicated deal team through the entire life of the investment. Saw Mill Capital

555 Pleasantville Road

• We work for our management teams but are not involved in day-to-day operations.

South Building, Suite 220

• We are operationally minded investors but do not use operating partners. Briarcliff Manor, NY 10510

• We build highly-relevant, industry-sourced board of directors for each company. (914) 741-1300 | sawmillcapital.com