Page 173 - TACC 2023 Program

P. 173

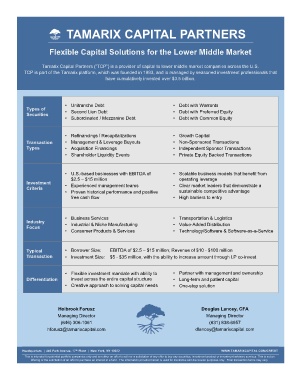

TAMARIX CAPITAL PARTNERS

Flexible Capital Solutions for the Lower Middle Market

Tamarix Capital Partners (“TCP”) is a provider of capital to lower middle market companies across the U.S.

TCP is part of the Tamarix platform, which was founded in 1993, and is managed by seasoned investment professionals that

have cumulatively invested over $3.5 billion.

• Unitranche Debt • Debt with Warrants

Types of • Second Lien Debt • Debt with Preferred Equity

Securities

• Subordinated / Mezzanine Debt • Debt with Common Equity

• Refinancings / Recapitalizations • Growth Capital

Transaction • Management & Leverage Buyouts • Non-Sponsored Transactions

Types • Acquisition Financings • Independent Sponsor Transactions

• Shareholder Liquidity Events • Private Equity Backed Transactions

• U.S.-based businesses with EBITDA of • Scalable business models that benefit from

$2.5 – $15 million operating leverage

Investment • Experienced management teams • Clear market leaders that demonstrate a

Criteria

• Proven historical performance and positive sustainable competitive advantage

free cash flow • High barriers to entry

• Business Services • Transportation & Logistics

Industry • Industrial & Niche Manufacturing • Value-Added Distribution

Focus

• Consumer Products & Services • Technology/Software & Software-as-a-Service

Typical • Borrower Size: EBITDA of $2.5 – $15 million; Revenue of $10 - $100 million

Transaction • Investment Size: $5 - $35 million, with the ability to increase amount through LP co-invest

• Flexible investment mandate with ability to • Partner with management and ownership

Differentiation invest across the entire capital structure • Long-term and patient capital

• Creative approach to solving capital needs • One-stop solution

Holbrook Forusz Douglas Lancey, CFA

Managing Director Managing Director

(646) 306-1061 (631) 838-6957

[email protected] [email protected]

Headquarters | 445 Park Avenue, 17 th Floor | New York, NY 10022 WWW.TAMARIXCAPITAL.COM/CREDIT

This is intended for potential portfolio companies only and is neither an offer to sell nor a solicitation of any offer to buy any securities, investment product or investment advisory services. This is not an

offering or the solicitation of an offer to purchase an interest in a fund. The information provided herein is used for illustrative and discussion purposes only. Final transaction terms may vary.