Page 82 - TACC 2025 Program

P. 82

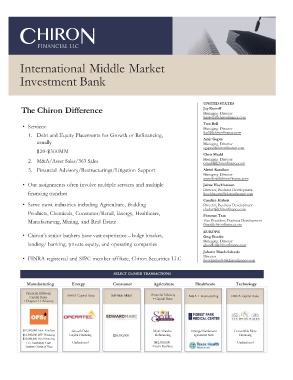

Non-Control Capital For The Middle Market®

Investment Criteria

$20-$300M $4M $5-$60M

Sales Minimum EBITDA Investment Size

Industries Investment Security Transaction Types

• MANUFACTURING • UNITRANCHE DEBT • ACQUISITIONS & GROWTH

• BUSINESS SERVICES • SUBORDINATED DEBT • SHAREHOLDER LIQUIDITY

• DISTRIBUTION • PREFERRED EQUITY • DEBT REFINACING

• FOOD AND BEVERAGE • COMMON EQUITY • MANAGEMENT BUYOUT & ESOP

• HEALTHCARE • INDEPENDENT SPONSOR LBO

RECENT INVESTMENTS

Acquisition Finance & Growth Capital Common Equity & Subordinated Debt

OneroRx provides integrated pharmacy services and medical supplies to underserved areas

across the Midwest, filling over 3 million prescriptions annually at 65 locations in six states.

The company provides retail, specialty, and telepharmacy services to individuals, hospitals,

and long-term care facilities.

West Des Moines, Iowa

Minority Recap & Refinance Subordinated Debt & Preferred Equity

Backyard Products is a manufacturer, distributor and installer of residential wood shed and

playset structures. The company has a leading market position in wood sheds in North America,

serving both the do-it-yourself (DIY) and do-it-for-me market segments. Backyard also offers

residential playsets and accessories.

Monroe, Michigan

Minority Recap & Growth Capital Subordinated Debt & Preferred Equity

Hirsch is a value-added distributor of commercial embroidery and direct-to-garment digital

printing equipment, textile bridge lasers and related equipment, software, parts and accessories.

Huntersville, North Carolina

ESOP Buyout Subordinated Debt

D.P. Nicoli is a leading provider of shoring equipment rental services to public utilities,

municipalities and contractors in western states. The company is a one-stop resource supplying

steel and aluminum trench shields, hydraulic shoring, steel plates and related products utilized

in underground construction.

Lake Oswego, Oregon

Independent Sponsor Buyout Debt & Common Equity

Washington Metal Fabricators provides full-service contract metal fabrication services,

including cutting, machining, assembly, painting and packaging. Their products range from HVAC

components to heavy truck brackets and transformer tanks.

Washington, Missouri