Page 111 - TACC 2023 Program

P. 111

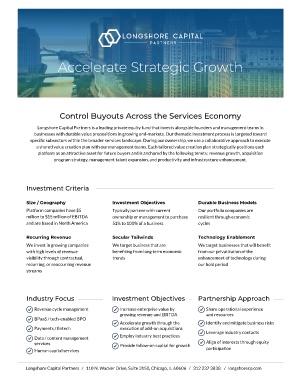

Accelerate Strategic Growth

Control Buyouts Across the Services Economy

Longshore Capital Partners is a leading private equity fund that invests alongside founders and management teams in

businesses with durable value propositions in growing end-markets. Our thematic investment process is targeted toward

specific subsectors within the broader services landscape. During our ownership, we use a collaborative approach to execute

a shared value creation plan with our management teams. Each tailored value creation plan strategically positions each

platform as an attractive asset for future buyers and is anchored by the following tenets: revenue growth, acquisition

program strategy, management talent expansion, and productivity and infrastructure enhancement.

Investment Criteria

Size / Geography Investment Objectives Durable Business Models

Platform companies have $5 Typically partner with current Our portfolio companies are

million to $15 million of EBITDA ownership or management to purchase resilient through economic

and are based in North America 51% to 100% of a business cycles

Recurring Revenue Secular Tailwinds Technology Enablement

We invest in growing companies We target business that are We target businesses that will benefit

with high levels of revenue benefiting from long term economic from our privatization of the

visibility through contractual, trends enhancement of technology during

recurring, or reoccurring revenue our hold period

streams

Industry Focus Investment Objectives Partnership Approach

Revenue cycle management Increase enterprise value by Share operational experience

growing revenue and EBITDA and resources

BPaaS / tech-enabled BPO

Accelerate growth through the Identify and mitigate business risks

Payments / fintech execution of add-on acquisitions

Leverage industry contacts

Data / content management Employ industry best practices

services Provide follow-on capital for growth Align of interests through equity

Human capital services participation

Longshore Capital Partners / 110 N. Wacker Drive, Suite 3150, Chicago, IL 60606 / 312 237 3838 / longshorecp.com