Page 154 - TACC 2023 Program

P. 154

Investing since 1968

Enabling management teams to achieve extraordinary results

UNION CAPITAL OVERVIEW:

Union Capital has a long history of providing investment solutions to business owners and management

teams of lower middle market businesses. By focusing exclusively on the lower middle market segment

for nearly fifty years, our team has a deep understanding of the issues faced by these management

teams as well as the paths to assist them in accelerating growth. The firm is investing out of its latest

fund with over $300 million of committed capital.

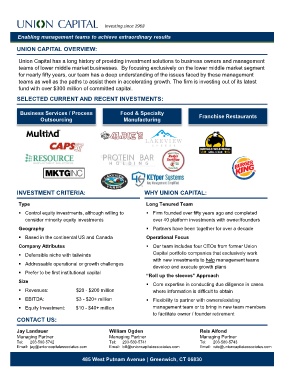

SELECTED CURRENT AND RECENT INVESTMENTS:

Business Services / Process Food & Specialty

Outsourcing Manufacturing Franchise Restaurants

INVESTMENT CRITERIA: WHY UNION CAPITAL:

Type Long Tenured Team

▪ Control equity investments, although willing to ▪ Firm founded over fifty years ago and completed

consider minority equity investments over 40 platform investments with owner/founders

Geography ▪ Partners have been together for over a decade

▪ Based in the continental US and Canada Operational Focus

Company Attributes ▪ Our team includes four CEOs from former Union

▪ Defensible niche with tailwinds Capital portfolio companies that exclusively work

with new investments to help management teams

▪ Addressable operational or growth challenges

develop and execute growth plans

▪ Prefer to be first institutional capital

“Roll up the sleeves” Approach

Size

▪ Core expertise in conducting due diligence in cases

▪ Revenues: $20 - $200 million where information is difficult to obtain

▪ EBITDA: $3 - $20+ million ▪ Flexibility to partner with owners/existing

▪ Equity Investment: $10 - $40+ million management team or to bring in new team members

to facilitate owner / founder retirement

CONTACT US:

Jay Landauer William Ogden Reis Alfond

Managing Partner Managing Partner Managing Partner

Tel: 203-580-5742 Tel: 203-580-5741 Tel: 203-580-5743

Email: jay@unioncapitalassociates.com Email: bill@unioncapitalassociates.com Email: reis@unioncapitalassociates.com

485 West Putnam Avenue | Greenwich, CT 06830