Page 158 - TACC 2023 Program

P. 158

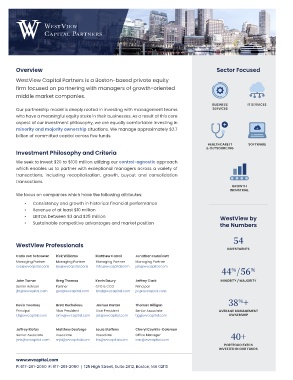

Overview Sector Focused

WestView Capital Partners is a Boston-based private equity

firm focused on partnering with managers of growth-oriented

middle market companies.

BUSINESS IT SERVICES

Our partnership model is deeply rooted in investing with management teams SERVICES

who have a meaningful equity stake in their businesses. As a result of this core

aspect of our investment philosophy, we are equally comfortable investing in

minority and majority ownership situations. We manage approximately $2.7

billion of committed capital across five funds.

HEALTHCARE IT SOFTWARE

& OUTSOURCING

Investment Philosophy and Criteria

We seek to invest $20 to $100 million utilizing our control-agnostic approach

which enables us to partner with exceptional managers across a variety of

transactions, including recapitalization, growth, buyout and consolidation

transactions.

GROWTH

INDUSTRIAL

We focus on companies which have the following attributes:

• Consistency and growth in historical financial performance

• Revenue of at least $10 million

• EBITDA between $3 and $25 million

WestView by

• Sustainable competitive advantages and market position

the Numbers

54

WestView Professionals

INVESTMENTS

Carlo von Schroeter Rick Williams Matthew Carroll Jonathan Hunnicutt

Managing Partner Managing Partner Managing Partner Managing Partner

cvs@wvcapital.com rjw@wvcapital.com mtc@wvcapital.com jeh@wvcapital.com

%

44 /56 %

John Turner Greg Thomas Kevin Daury Jeffrey Clark MINORITY / MAJORITY

Senior Advisor Partner CFO & CCO Principal

jht@wvcapital.com gwt@wvcapital.com kmd@wvcapital.com jlc@wvcapital.com

%

38 +

Kevin Twomey Brett Rocheleau Joshua Kantor Thomas Gilligan

Principal Vice President Vice President Senior Associate AVERAGE MANAGEMENT

kjt@wvcapital.com bmr@wvcapital.com jak@wvcapital.com tjg@wvcapital.com OWNERSHIP

Jeffrey Klofas Matthew Desforge Louie Steffens Cheryl Czyrklis-Coleman

Senior Associate Associate Associate Office Manager 40+

jmk@wvcapital.com mjd@wvcapital.com lns@wvcapital.com cac@wvcapital.com

PORTFOLIO EXECS

INVESTED IN OUR FUNDS

www.wvcapital.com

P: 617-261-2050 F: 617-261-2060 | 125 High Street, Suite 2612, Boston, MA 02110