Page 161 - TACC 2023 Program

P. 161

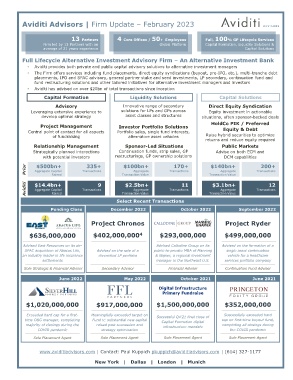

Aviditi Advisors | Firm Update – February 2023

13 Partners 4 Core Offices / 50+ Employees Full, 100% GP Lifecycle Services

Firm led by 13 Partners with an Global Platform Capital Formation, Liquidity Solutions &

average of 21 years experience Capital Solutions

Full Lifecycle Alternative Investment Advisory Firm – An Alternative Investment Bank

• Aviditi provides both private and public capital advisory solutions to alternative investment managers

• The Firm offers services including fund placements, direct equity syndications (buyout, pre-IPO, etc.), multi-tranche debt

placements, IPO and SPAC advisory, general partner stake and seed investments, LP secondary, continuation fund and

fund restructuring solutions and other tailored initiatives for alternative investment managers and investors

• Aviditi has advised on over $20bn of total transactions since inception

Capital Formation Liquidity Solutions Capital Solutions

Advisory Innovative range of secondary Direct Equity Syndication

Leveraging extensive experience to solutions for LPs and GPs across Equity investment in actionable

develop optimal strategy asset classes and structures situations, often sponsor-backed deals

Project Management Investor Portfolio Solutions HoldCo PIK / Preferred

Central point of contact for all aspects Portfolio sales, single fund interests, Equity & Debt

of fundraising alternative asset vehicles Raise hybrid securities to optimize

returns and reduce equity required

Relationship Management Sponsor-Led Situations Public Markets

Strategically planned interactions Continuation funds, strip sales, GP Advise on both ECM and

with potential investors restructurings, GP ownership solutions DCM capabilities

$500bn+

200+

$140bn+

335+

$100bn+

170+

Prior Aggregate Capital Transactions Transaction Value Transactions Transaction Value Transactions

Aggregate

Aggregate

Raised

12

9

11

$3.1bn+

$2.5bn+

Aviditi $14.4bn+ Transactions Transaction Value Transactions Transaction Value Transactions

Aggregate

Aggregate

Aggregate Capital

Raised

Select Recent Transactions

Pending Close December 2022 October 2022 September 2022

Project Chronos Project Ryder

$636,000,000 $402,000,000 4 $293,000,000 $499,000,000

Advised East Resources on its de- Advised Callodine Group on its Advised on the formation of a

SPAC acquisition of Abacus Life, Advised on the sale of a public-to-private M&A of Manning single asset continuation

an industry leader in life insurance diversified LP portfolio & Napier, a regional investment vehicle for a healthcare

settlements manager in the Northeast U.S. services portfolio company

Sole Strategic & Financial Advisor Secondary Advisor Financial Advisor Continuation Fund Advisor

June 2022 May 2022 October 2021 June 2021

Digital Infrastructure

Primary Fundraise

$1,020,000,000 $917,000,000 $1,500,000,000 $352,000,000

Exceeded hard cap for a first- Meaningfully exceeded target on Successful Q4’21 final close of Successfully exceeded hard

time O&G manager, completing Fund V; substantial new capital Capital Formation digital cap on first-time buyout fund,

majority of closings during the raised post succession and infrastructure mandate completing all closings during

COVID pandemic strategy optimization the COVID pandemic

Sole Placement Agent Sole Placement Agent Sole Placement Agent Sole Placement Agent

www.aviditiadvisors.com | Contact: Paul Kuppich pkuppich@aviditiadvisors.com | (614) 327-1177

New York | Dallas | London | Munich