Page 176 - TACC 2023 Program

P. 176

Advising middle market companies to

successful conclusions for capital raising

and M&A transactions.

M&A | Capital | Strategy

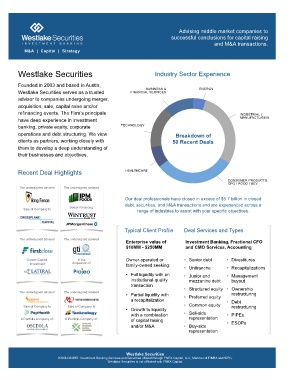

Westlake Securities Industry Sector Experience

Founded in 2003 and based in Austin,

BUSINESS &

Westlake Securities serves as a trusted FINANCIAL SERVICES ENERGY

advisor to companies undergoing merger,

acquisition, sale, capital raise and/or

refinancing events. The Firm’s principals INDUSTRIAL /

have deep experience in investment MANUFACTURING

banking, private equity, corporate TECHNOLOGY

operations and debt structuring. We view Breakdown of

clients as partners, working closely with 50 Recent Deals

them to develop a deep understanding of

their businesses and objectives.

Recent Deal Highlights HEALTHCARE

CONSUMER PRODUCTS

CPG / FOOD / BEV

The undersigned advised The undersigned advised

Our deal professionals have closed in excess of $5.7 billion in closed

debt, securities, and M&A transactions and are experienced across a

Senior Financing

Sale of Company to range of industries to assist with your specific objectives.

Typical Client Profile Deal Services and Types

The undersigned advised The undersigned advised

Enterprise value of

Investment Banking, Fractional CFO

$10MM - $250MM and CMO Services, Accounting

Growth Capital In the

Owner-operated or

• Senior debt • Divestitures

Investment Acquisition of family-owned seeking:

• Unitranche • Recapitalizations

• Full liquidity with an

• Junior and

• Management

institutional-quality mezzanine debt buyout

transaction

• Structured equity • Ownership

The undersigned advised The undersigned advised restructuring

• Partial liquidity with

• Preferred equity

a recapitalization • Debt

Sale of Company to Sale of Company to • Common equity restructuring

• Growth to liquidity

with a combination

• Sell-side • PIPEs

A Portfolio Company of: A Portfolio Company of: representation

of capital raising

• ESOPs

and/or M&A • Buy-side

representation

Westlake Securities

DISCLOSURE: Investment Banking Services and Securities offered through FNEX Capital, LLC, Member of FINRA and SIPC.

Westlake Securities is not affiliated with FNEX Capital.