Page 59 - TACC 2023 Program

P. 59

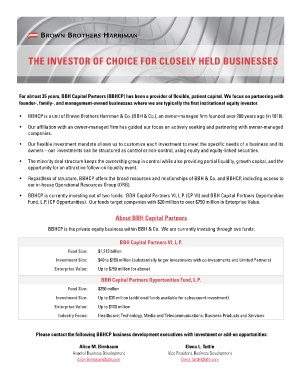

THE INVESTOR OF CHOICE FOR CLOSELY HELD BUSINESSES

THE INVESTOR OF CHOICE FOR CLOSELY HELD BUSINESSES

For almost 35 years, BBH Capital Partners (BBHCP) has been a provider of flexible, patient capital. We focus on partnering with

For almost 35 years, BBH Capital Partners (BBHCP) has been a provider of flexible, patient capital. We focus on partnering with

founder-, family-, and management-owned businesses where we are typically the first institutional equity investor.

founder-, family-, and management-owned businesses where we are typically the first institutional equity investor.

• BBHCP is a unit of Brown Brothers Harriman & Co. (BBH & Co.), an owner-managed firm founded over 200 years ago (in 1818).

•

BBHCP is a unit of Brown Brothers Harriman & Co. (BBH & Co.), an owner-managed firm founded over 200 years ago (in 1818).

• Our affiliation with an owner-managed firm has guided our focus on actively seeking and partnering with owner-managed

•

Our affiliation with an owner-managed firm has guided our focus on actively seeking and partnering with owner-managed

companies.

companies.

• Our flexible investment mandate allows us to customize each investment to meet the specific needs of a business and its

•

Our flexible investment mandate allows us to customize each investment to meet the specific needs of a business and its

owners – our investments can be structured as control or non-control, using equity and equity-linked securities.

owners – our investments can be structured as control or non-control, using equity and equity-linked securities.

• The minority deal structure keeps the ownership group in control while also providing partial liquidity, growth capital, and the

The minority deal structure keeps the ownership group in control while also providing partial liquidity, growth capital, and the

•

opportunity for an attractive follow-on liquidity event.

opportunity for an attractive follow-on liquidity event.

•

Regardless of structure, BBHCP offers the broad resources and relationships of BBH & Co. and BBHCP, including access to

• Regardless of structure, BBHCP offers the broad resources and relationships of BBH & Co. and BBHCP, including access to

our in-house Operational Resources Group (ORG).

our in-house Operational Resources Group (ORG).

BBHCP is currently investing out of two funds: BBH Capital Partners VI, L.P. (CP VI) and BBH Capital Partners Opportunities

•

• BBHCP is currently investing out of two funds: BBH Capital Partners VI, L.P. (CP VI) and BBH Capital Partners Opportunities

Fund, L.P. (CP Opportunities). Our funds target companies with $20 million to over $750 million in Enterprise Value.

Fund, L.P. (CP Opportunities). Our funds target companies with $20 million to over $750 million in Enterprise Value.

About BBH Capital Partners

About BBH Capital Partners

BBHCP is the private equity business within BBH & Co. We are currently investing through two funds:

BBHCP is the private equity business within BBH & Co. We are currently investing through two funds:

BBH Capital Partners VI, L.P.

BBH Capital Partners VI, L.P.

Fund Size: $1.215 billion

Fund Size: $1.215 billion

Investment Size: $40 to $150 million (substantially larger investments with co-investments and Limited Partners)

Investment Size: $40 to $150 million (substantially larger investments with co-investments and Limited Partners)

Enterprise Value: Up to $750 million (or above)

Enterprise Value: Up to $750 million (or above)

BBH Capital Partners Opportunities Fund, L.P.

BBH Capital Partners Opportunities Fund, L.P.

Fund Size: $250 million

Fund Size: $250 million

Investment Size: Up to $30 million (additional funds available for subsequent investment)

Investment Size: Up to $30 million (additional funds available for subsequent investment)

Enterprise Value:

Up to $100 million

Enterprise Value: Up to $100 million

Healthcare; Technology, Media and Telecommunications; Business Products and Services

Industry Focus:

Industry Focus: Healthcare; Technology, Media and Telecommunications; Business Products and Services

Please contact the following BBHCP business development executives with investment or add-on opportunities:

Please contact the following BBHCP business development executives with investment or add-on opportunities:

Alice M. Birnbaum Elena L. Tuttle

Head of Business Development Vice President, Business Development

Alice M. Birnbaum Elena L. Tuttle

Elena.Tuttle@bbh.com

Alice.Birnbaum@bbh.com

Head of Business Development Vice President, Business Development

Alice.Birnbaum@bbh.com Elena.Tuttle@bbh.com