Page 55 - TACC 2023 Program

P. 55

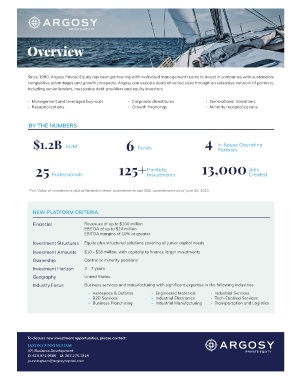

Overview

Since 1990, Argosy Private Equity has been partnering with motivated management teams to invest in companies with sustainable

competitive advantages and growth prospects. Argosy can execute deals of varied sizes through an extensive network of partners,

including senior lenders, mezzanine debt providers and equity investors.

• Management and leveraged buy-outs • Corporate divestitures • Generational transitions

• Recapitalizations • Growth financings • Minority recapitalizations

BY THE NUMBERS

6 4 In-house Operating

$1.2B AUM 1 Funds Partners

125+ Portfolio 13,000 Jobs

25 Professionals Investments Created

1 Fair Value of investments plus unfunded investor commitments and SBA commitments as of June 30, 2022.

NEW PLATFORM CRITERIA

Financial Revenues of up to $100 million

EBITDA of up to $10 million

EBITDA margins of 10% or greater

Investment Structures Equity plus structured solutions covering all junior capital needs

Investment Amounts $10 - $35 million, with capacity to finance larger investments

Ownership Control or minority positions

Investment Horizon 3 – 7 years

Geography United States

Industry Focus Business services and manufacturing with significant expertise in the following industries:

• Aerospace & Defense • Engineered Materials • Industrial Services

• B2B Services • Industrial Electronics • Tech-Enabled Services

• Business Franchising • Industrial Manufacturing • Transportation and Logistics

To discuss new investment opportunities, please contact:

JASON CUNNINGHAM

VP, Business Development

O: 610.971.9685 M: 267.275.1318

jcunningham@argosycapital.com