Page 50 - TACC 2023 Program

P. 50

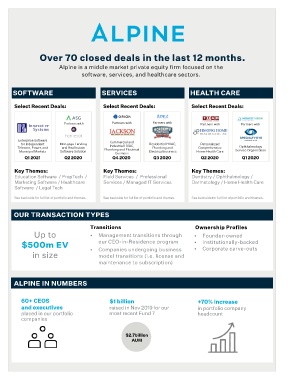

Over 70 closed deals in the last 12 months.

Alpine is a middle market private equity firm focused on the

software, services, and healthcare sectors.

SOFTWARE SERVICES HEALTH CARE

Select Recent Deals: Select Recent Deals: Select Recent Deals:

Partners with Partners with Partners with Partners with Partners with

Enterprise Software Commercial and

for Independent Mortgage Lending Industrial HVAC, Residential HVAC, Personalized

Telecom, Power, and and Real Estate Plumbing and Electrical Plumbing and Comprehensive Ophthalmology

Municipal Markets Software Solution Electrical business Home Health Care Service Organization

business

Q1 2021 Q2 2020 Q4 2020 Q3 2020 Q2 2020 Q1 2020

Key Themes: Key Themes: Key Themes:

Education Software / PropTech / Field Services / Professional Dentistry / Ophthalmology /

Marketing Software / Healthcare Services / Managed IT Services Dermatology / Home Health Care

Software / Legal Tech

See backside for full list of portfolio and themes. See backside for full list of portfolio and themes. See backside for full list of portfolio and themes.

OUR TRANSACTION TYPES

Transitions Ownership Profiles

Up to • Management transitions through • Founder-owned

$500m EV our CEO-in-Residence program • institutionally-backed

• Corporate carve-outs

in size • Companies undergoing business

model transitions (i.e. license and

maintenance to subscription)

ALPINE IN NUMBERS

60+ CEOS $1 billion +70% increase

and executives raised in Nov 2019 for our in portfolio company

placed in our portfolio most recent Fund 7 headcount

companies

$2.7billion

AUM