Page 66 - TACC 2023 Program

P. 66

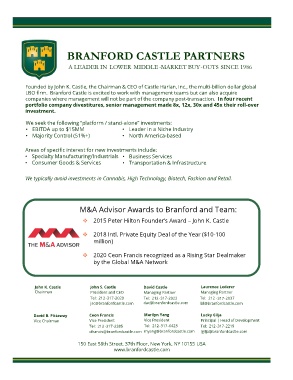

BRANFORD CASTLE PARTNERS

A LEADER IN LOWER MIDDLE-MARKET BUY-OUTS SINCE 1986

Founded by John K. Castle, the Chairman & CEO of Castle Harlan, Inc., the multi-billion dollar global

LBO firm. Branford Castle is excited to work with management teams but can also acquire

companies where management will not be part of the company post-transaction. In four recent

portfolio company divestitures, senior management made 8x, 12x, 30x and 45x their roll-over

investment.

We seek the following “platform / stand-alone” investments:

• EBITDA up to $15MM • Leader in a Niche Industry

• Majority Control (51%+) • North America-based

Areas of specific interest for new investments include:

• Specialty Manufacturing/Industrials • Business Services

• Consumer Goods & Services • Transportation & Infrastructure

We typically avoid investments in Cannabis, High Technology, Biotech, Fashion and Retail.

M&A Advisor Awards to Branford and Team:

❖ 2015 Peter Hilton Founder’s Award – John K. Castle

❖ 2018 Intl. Private Equity Deal of the Year ($10-100

million)

❖ 2020 Ceon Francis recognized as a Rising Star Dealmaker

by the Global M&A Network

John K. Castle John S. Castle David Castle Laurence Lederer

Chairman President and CEO Managing Partner Managing Partner

Tel: 212-317-2020 Tel: 212-317-2022 Tel: 212 -317-2037

jsc@branfordcastle.com dac@branfordcastle.com lbl@branfordcastle.com

David B. Pittaway Ceon Francis Marilyn Yang Lucky Gilja

Vice Chairman Vice President Vice President Principal | Head of Development

Tel: 212-317- -2385 Tel: 212-317-6423 Tel: 212-317-2219

cfrancis@branfordcastle.com myang@branfordcastle.com lgilja@branfordcastle.com

150 East 58th Street, 37th Floor, New York, NY 10155 USA

www.branfordcastle.com