Page 71 - TACC 2023 Program

P. 71

Ǧ

ǡ

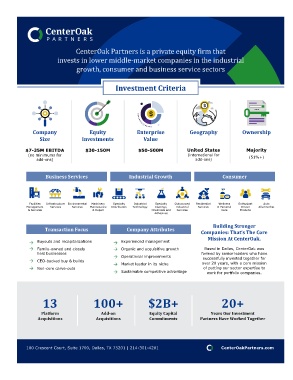

Investment Criteria

Company Equity Enterprise Geography Ownership

Size Investments Value

$7-35M EBITDA $30-150M $50-500M United States Majority

(no minimums for (international for (51%+)

add-ons) add-ons)

Business Services Industrial Growth Consumer

Facilities Infrastructure Environmental Machinery Specialty Industrial Specialty Outsourced Residential Wellness Enthusiast Auto

Management Services Services Maintenance Distribution Technology Coatings, Industrial Services & Personal Driven Aftermarket

& Services & Repair Chemicals and Services Care Products

Adhesives

Building Stronger

Transaction Focus Company Attributes Companies: That’s The Core

Mission At CenterOak.

Buyouts and recapitalizations Experienced management

Family-owned and closely Organic and acquisitive growth Based in Dallas, CenterOak was

held businesses formed by senior leaders who have

Operational improvements successfully invested together for

CEO-backed buy & builds

Market leader in its niche over 20 years, with a core mission

Non-core carve-outs of putting our sector expertise to

Sustainable competitive advantage work for portfolio companies.

13 100+ $2B+ 20+

Platform Add-on Equity Capital Years Our Investment

Acquisitions Acquisitions Commitments Partners Have Worked Together

100 Crescent Court, Suite 1700, Dallas, TX 75201 | 214-301-4201 CenterOakPartners.com