Page 83 - TACC 2023 Program

P. 83

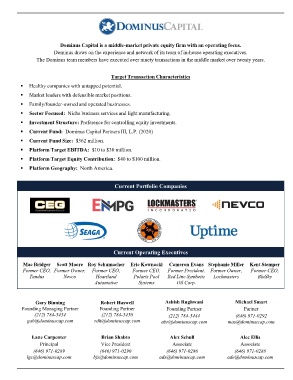

Dominus Capital is a middle-market private equity firm with an operating focus.

Dominus draws on the experience and network of its team of in-house operating executives.

The Dominus team members have executed over ninety transactions in the middle market over twenty years.

Target Transaction Characteristics

Healthy companies with untapped potential.

Market leaders with defensible market positions.

Family/founder-owned and operated businesses.

Sector Focused: Niche business services and light manufacturing.

Investment Structure: Preference for controlling equity investments.

Current Fund: Dominus Capital Partners III, L.P. (2020)

Current Fund Size: $362 million.

Platform Target EBITDA: $10 to $30 million.

Platform Target Equity Contribution: $40 to $100 million.

Platform Geography: North America.

Current Portfolio Companies

Current Operating Executives

Mac Bridger Scott Moore Roy Schumacher Eric Kownacki Cameron Evans Stephanie Miller Kent Stemper

Former CEO, Former Owner, Former CEO, Former CEO, Former President, Former Owner, Former CEO,

Tandus Nevco Heartland Polaris Pool Red Line Synthetic Lockmasters BluSky

Automotive Systems Oil Corp.

Gary Binning Robert Haswell Ashish Rughwani Michael Smart

Founding Managing Partner Founding Partner Founding Partner Partner

(212) 784-5454 (212) 784-5450 (212) 784-5444 (646) 971-0292

gab@dominuscap.com rdh@dominuscap.com abr@dominuscap.com mas@dominuscap.com

Lane Carpenter Brian Shabto Alex Schull Alec Ellis

Principal Vice President Associate Associate

(646) 971-0289 (646) 971-0290 (646) 971-0286 (646) 971-0288

lgc@dominuscap.com bjs@dominuscap.com ads@dominuscap.com ade@dominuscap.com