Page 186 - TACC 2023 Program

P. 186

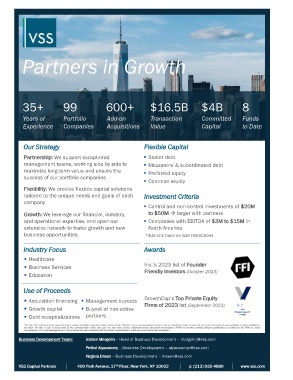

Partners in Growth

35+ 99 600+ $16.5B $4B 8

Years of Portfolio Add-on Transaction Committed Funds

Experience Companies Acquisitions Value Capital to Date

O Ouurr SSttrraatteeggyy F Flleexxiibbllee CCaappiittaall

P Paarrttnneerrsshhiipp:: We support exceptional ▪ Senior debt

management teams, working side by side to ▪ Mezzanine & subordinated debt

maximize long-term value and ensure the ▪ Preferred equity

success of our portfolio companies

▪ Common equity

F Flleexxiibbiilliittyy:: We provide flexible capital solutions

tailored to the unique needs and goals of each I Innvveessttmmeenntt CCrriitteerriiaa

company

▪ Control and non-control investments of $ $2200MM

G Grroowwtthh:: We leverage our financial, industry, t too $$5500MM → larger with partners

and operational expertise, and open our ▪ Companies with EBITDA of $ $33MM ttoo $$1155MM in

extensive network to foster growth and new North America

business opportunities *Add-ons have no size restrictions

I Inndduussttrryy FFooccuuss A Awwaarrddss

▪ Healthcare

▪ Business Services Inc.’s 2023 list of FFoouunnddeerr

F Frriieennddllyy IInnvveessttoorrss (October 2023)

▪ Education

U Ussee ooff PPrroocceeeeddss

▪ Acquisition financing ▪ Management buyouts GrowthCap’s TToopp PPrriivvaattee EEqquuiittyy

▪ Growth capital ▪ Buyout of non-active F Fiirrmmss ooff 22002233 list (September 2023)

▪ Debt recapitalizations partners

*The list of Recent Investments represents only a sample of portfolio companies held in various funds. This list is not a recommendation to buy or sell, nor should the reader assume that any of these investments were profitable or will be profitable in

the future. No offer or sale is being made by this communication. Offers and sales are only made via the confidential private placement memorandum (“PPM”) to investors meeting stringent qualifications as outlined in the PPM. In certain

circumstances, VSS Fund Management LLC has provided the award distributor with de minimis compensation to make use of such award and recognition.

B Buussiinneessss DDeevveellooppmmeenntt TTeeaamm:: J Joorrddaann MMaarrggoolliinn – Head of Business Development – [email protected]

P Prriitthhvvii AAiiyyaasswwaammyy – Business Development – [email protected]

V Viirrggiinniiaa BBrreeeenn – Business Development – [email protected]

t thh

V VSSSS CCaappiittaall PPaarrttnneerrss 4 40000 PPaarrkk AAvveennuuee,, 1177 FFlloooorr,, NNeeww YYoorrkk,, NNYY 1100002222 p p:: ((221122)) 993355--44999900 w wwwww..vvssss..ccoomm