Page 189 - TACC 2023 Program

P. 189

Overview

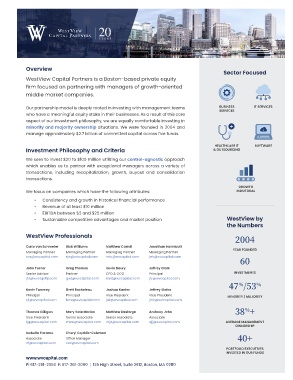

Sector Focused

WestView Capital Partners is a Boston-based private equity

firm focused on partnering with managers of growth-oriented

middle market companies.

Our partnership model is deeply rooted in investing with management teams BUSINESS IT SERVICES

SERVICES

who have a meaningful equity stake in their businesses. As a result of this core

aspect of our investment philosophy, we are equally comfortable investing in

minority and majority ownership situations. We were founded in 2004 and

manage approximately $2.7 billion of committed capital across five funds.

HEALTHCARE IT SOFTWARE

Investment Philosophy and Criteria & OUTSOURCING

We seek to invest $20 to $100 million utilizing our control-agnostic approach

which enables us to partner with exceptional managers across a variety of

transactions, including recapitalization, growth, buyout and consolidation

transactions.

GROWTH

We focus on companies which have the following attributes: INDUSTRIAL

• Consistency and growth in historical financial performance

• Revenue of at least $10 million

• EBITDA between $3 and $25 million

• Sustainable competitive advantages and market position WestView by

the Numbers

WestView Professionals

2004

Carlo von Schroeter Rick Williams Matthew Carroll Jonathan Hunnicutt

YEAR FOUNDED

Managing Partner Managing Partner Managing Partner Managing Partner

[email protected] [email protected] [email protected] [email protected]

60

John Turner Greg Thomas Kevin Daury Jeffrey Clark

Senior Advisor Partner CFO & CCO Principal INVESTMENTS

[email protected] [email protected] [email protected] [email protected]

%

47 /53 %

Kevin Twomey Brett Rocheleau Joshua Kantor Jeffrey Klofas

Principal Principal Vice President Vice President MINORITY / MAJORITY

[email protected] [email protected] [email protected] [email protected]

%

Thomas Gilligan Mary Kate Marino Matthew Desforge Anthony John 38 +

Vice President Senior Associate Senior Associate Associate

[email protected] [email protected] [email protected] [email protected] AVERAGE MANAGEMENT

OWNERSHIP

Isabella Floramo Cheryl Czyrklis-Coleman

40+

Associate Office Manager

[email protected] [email protected]

PORTFOLIO EXECUTIVES

INVESTED IN OUR FUNDS

www.wvcapital.com

P: 617-261-2050 F: 617-261-2060 | 125 High Street, Suite 2612, Boston, MA 02110